http://kkbcpa.com/wp-content/uploads/2022/08/shutterstock_698158717.jpg

334

500

KKB CPAs

https://kkbcpa.com/wp-content/uploads/2021/12/KKB-Logo-w-text.png

KKB CPAs2022-08-10 17:44:262022-09-06 16:49:46FTB Error – PTE Refunds Must be Returned

http://kkbcpa.com/wp-content/uploads/2022/08/shutterstock_698158717.jpg

334

500

KKB CPAs

https://kkbcpa.com/wp-content/uploads/2021/12/KKB-Logo-w-text.png

KKB CPAs2022-08-10 17:44:262022-09-06 16:49:46FTB Error – PTE Refunds Must be ReturnedLatest Posts

http://kkbcpa.com/wp-content/uploads/2022/08/shutterstock_698158717.jpg

334

500

KKB CPAs

https://kkbcpa.com/wp-content/uploads/2021/12/KKB-Logo-w-text.png

KKB CPAs2022-08-10 17:44:262022-09-06 16:49:46FTB Error – PTE Refunds Must be Returned

http://kkbcpa.com/wp-content/uploads/2022/08/shutterstock_698158717.jpg

334

500

KKB CPAs

https://kkbcpa.com/wp-content/uploads/2021/12/KKB-Logo-w-text.png

KKB CPAs2022-08-10 17:44:262022-09-06 16:49:46FTB Error – PTE Refunds Must be Returned

Estimated tax payments: Who owes them and when is the next one due?

Self-employed taxpayers generally must make quarterly estimated tax payments. But even if you’re not self-employed, you may have to make them to avoid a penalty if you don’t have enough federal tax withheld. Here are the rules.

Bonus Depreciation: Businesses Should Act Now

If your business plans to purchase bonus depreciation qualifying property, take action soon to realize a valuable tax break.

Three Tax Breaks for Small Businesses

You don’t have to be a large business to benefit from tax breaks. Here are 3 ways that eligible small businesses can save on taxes.

Important Considerations When Engaging in a Like-Kind Exchange

Interested in a “like-kind” exchange of real property? Here are the basic rules.

Interested in an Electric Vehicle? How to Qualify for a Powerful Tax Credit

Many people are thinking about buying electric vehicles because of their advanced technology, high gas prices and the fact there are more models available today. Along with factors like acceleration and the battery range, check out the federal tax break that may be available.

How Do Taxes Factor into an M&A Transaction?

Buying or selling a business may be the most critical transaction you ever make. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Here are some considerations.

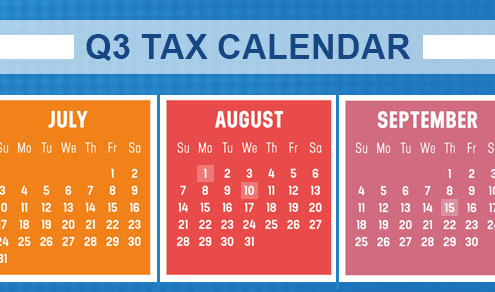

2022 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

If you’re a business owner or executive, you might be taking it a little easy this summer. But don’t take it so easy that you forget about these third-quarter tax deadlines.

Your Estate Plan: Don’t Forget About Income Tax Planning

With the federal estate tax exemption currently so large, you may want to devote more time to saving income taxes for your heirs.